- Blog

No More Weighting: A Look Back at the Covid-19 Vaccine Timeline and What Emerging Drug Trials Can Learn

June 5, 2024

The rapid COVID-19 timeline brought the world to a standstill. It emptied out streets, cleared out offices, grounded the travel industry, shut down theaters, factories, and malls, and flooded hospitals. In the span of mere days, major cities saw the smog clear from their skies for the first time in years, but they also saw their population dwindle at rates unseen in the 21st century.

With daily deaths in the thousands in the peak of 2020, the race to find a vaccine and return people to a semblance of normalcy demanded a change in clinical trial processes and global collaboration.

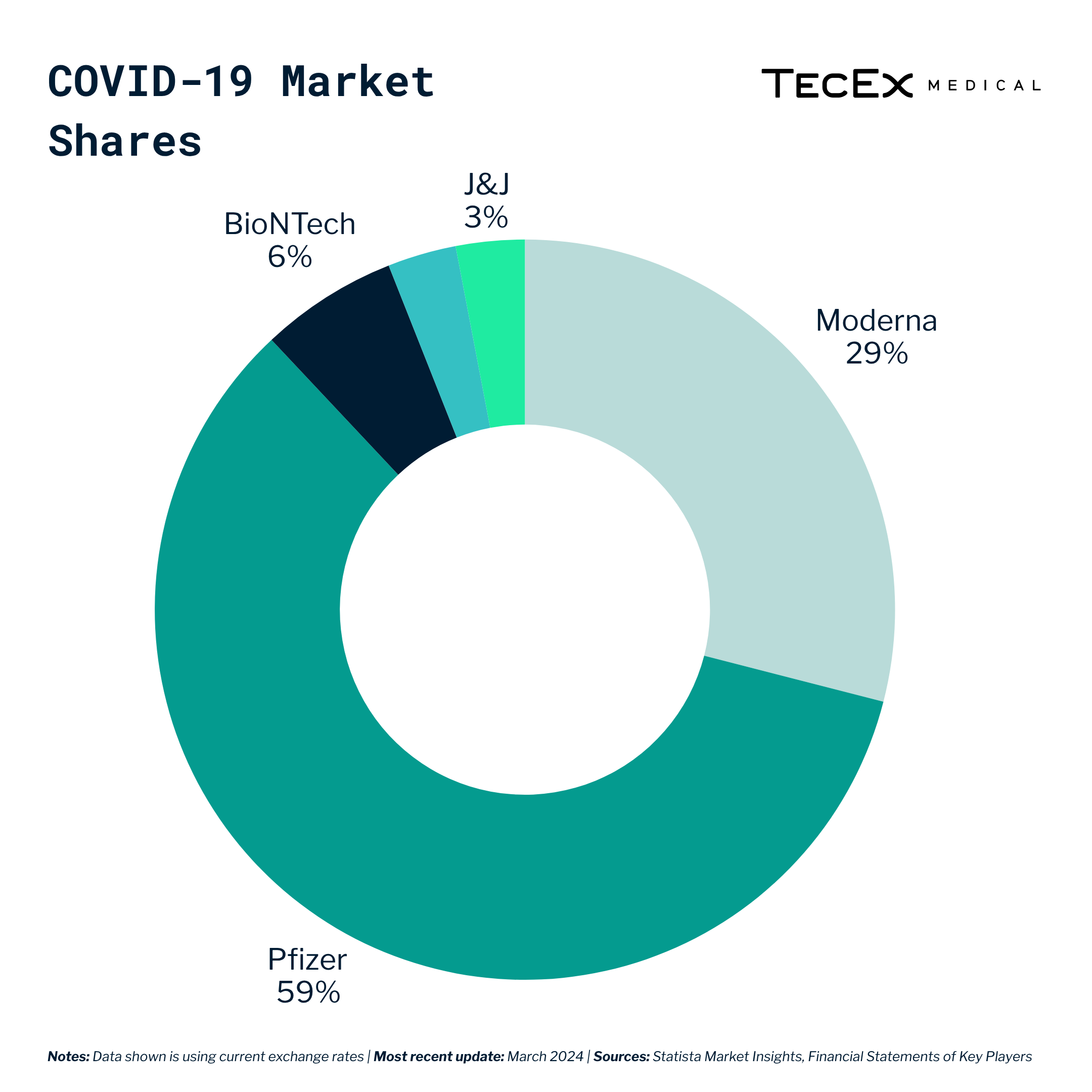

As a result, the COVID-19 vaccine market grew to an estimated 130-billion dollar market, with big players like J&J, Moderna, and Pfizer vying for the lion’s share.

This market is expected to shrink significantly with successful vaccine rollouts stifling the COVID-19 infection rate. Thus, pharmaceutical stakeholders have now diverted their attention to another health crisis affecting over 2.5 billion adults – obesity diagnosis.

In 2022…43% of adults aged 18 years and over [were] overweight; an increase from 1990, when 25% of adults aged 18 years and over were overweight. – WHO

According to analysts at Goldman Sachs Group Inc., the weight-loss drug market is projected to reach an estimated value of $100 billion by 2030. Pharmaceutical heavyweights Novo Nordisk and Eli Lily have already made significant strides in this market, both launching their own weight-loss drugs – Wegovy and Zepbound, respectively – after successful clinical trials that have shown great results with minimal side effects.

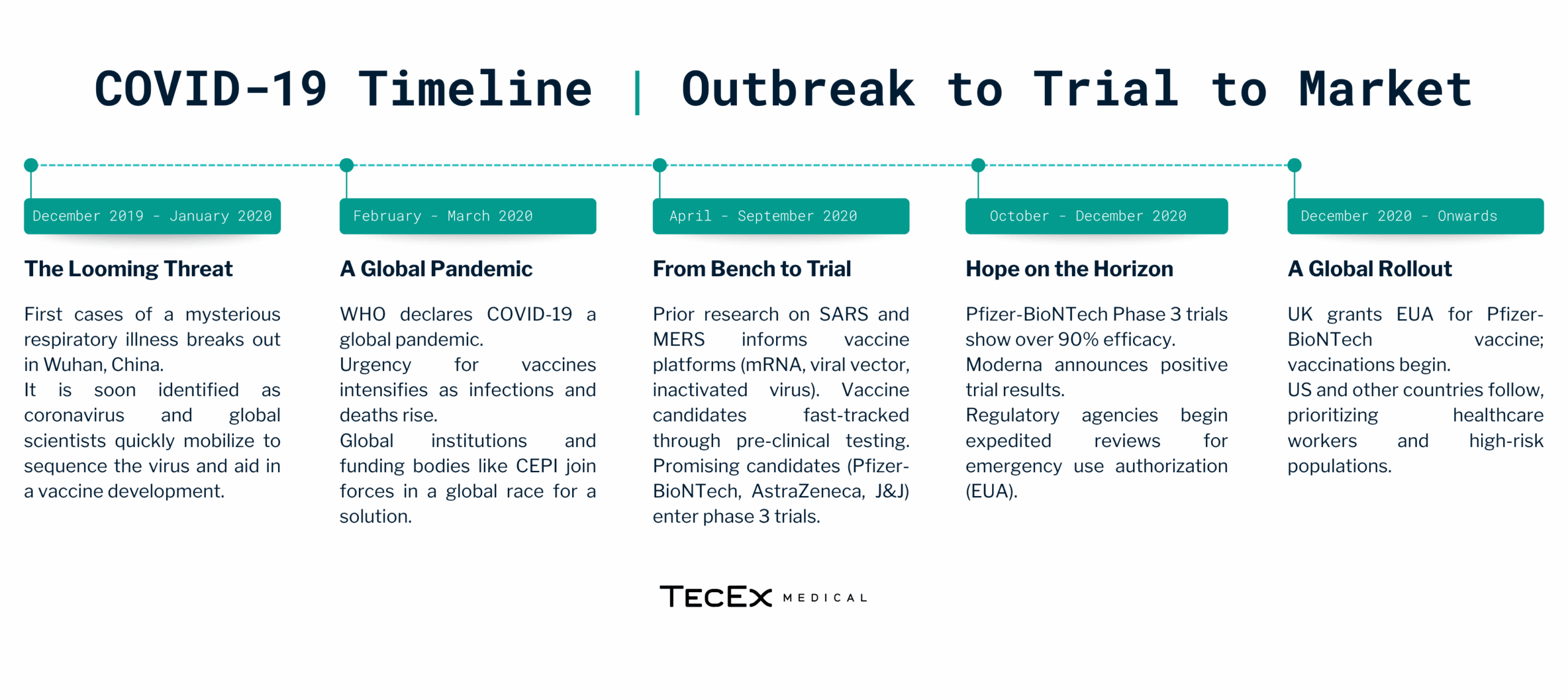

Coronavirus Case Study: From Outbreak to Rollout

The emergence of COVID-19 in late 2019 sparked an unprecedented global effort to develop vaccines. Leveraging years of prior research on coronaviruses, scientists rapidly identified the viral genome by January 2020. This swift identification allowed for the development of targeted vaccines at an accelerated pace. Within months, several companies, including Johnson & Johnson (J&J) and AstraZeneca, initiated clinical trials for vaccines. Here is a look at the COVID-19 timeline from outbreak to vaccine rollout.

How Did J&J and AstraZeneca Get to Market so Quickly

J&J (Johnson & Johnson) and AstraZeneca were frontrunners in the race for a COVID-19 vaccine due to a well-orchestrated strategy that balanced speed with scientific rigor. Factors that fuelled their success include:

Resource Allocation and Efficient Supply Chain

The COVID-19 pandemic was not merely a health crisis but a global emergency. J&J and AstraZeneca invested substantial financial resources, recruited top researchers, and streamlined internal processes and procurement strategies to accelerate development. This focus enabled quicker decision-making and reduced bureaucratic hurdles. A streamlined central procurement strategy can drastically alter the success of your supply chain. Clinical trials are more likely to meet budgets and deadlines if the supply chain is optimized.

Regulatory Expediency and First-Time Clearance:

Regulatory bodies like the US FDA recognized the urgency of the COVID-19 pandemic and implemented fast-track programs for vaccines, allowing overlapping clinical trial phases. Traditionally, data from one phase needed to be finalized before proceeding to the next. With these programs, promising initial results from early phases could inform the design of later trials, saving crucial months. Importantly, this streamlined approach did not compromise essential safety measures; rigorous data collection and analysis ensured that vaccines met stringent safety and efficacy standards. Global clinical trials needed supplies to clear customs to meet the SIV dates without any hassles. This is made possible with the help of trade compliance specialists and a medical Importer of Record who understands the regulatory requirements of each region.

Rise in Obesity: Timeline of Weight-Loss Drug Developments

Unlike the rapid COVID-19 timeline for vaccine development, the development of effective and safe obesity drugs has been a long and winding road. The fight against obesity is constantly evolving, with new treatment options emerging from the world of clinical trials. Let’s have a look at the current landscape for weight-loss drugs:

Weight-Loss Drugs Following Covid Model to Market

In efforts to get their piece of the billion-dollar industry, obesity drug trials are being streamlined to expedite timelines and reach the market quickly. However, ensuring safety remains a paramount concern. Both Wegovy and Zepbound have undergone rigorous testing, and regulatory bodies carefully review data to ensure they meet safety standards before approval.

Streamlining procurement processes in clinical trials is essential for reducing overhead costs and enhancing operational efficiency. By centralizing procurement, organizations can better manage costs and mitigate risks, leading to more sustainable and effective clinical trial operations.

Managing all the data and transporting trial materials to and from sites can be a significant burden. As pharmaceutical companies focus on addressing the crisis, enlisting project management specialists like TecEx Medical helps facilitate the global movement of trial-related materials, ensuring compliance with the regulatory requirements of each country involved and bypassing compliance hurdles at customs.

What about those slower to market?

It’s challenging to quantify the exact revenue lost by slower companies due to the rapid timeline of COVID-19 vaccines. However, estimates suggest the global COVID-19 vaccine market could reach a staggering US$ 466 billion by 2025. This immense market potential highlights the significant financial incentive for companies to be first movers. Companies that entered the market later, even by a few months, might have missed out on a substantial portion of this revenue, particularly during the initial stages of high demand when governments were racing to secure enough vaccines for their populations.

Furthermore, being first to market can also lead to brand recognition and a perception of leadership in the field, potentially influencing future purchasing decisions and market share. Likewise, players in the weight loss drug market are looking to catch up to Novo Nordisk and Eli Lily and gain access to the lucrative space as soon as possible.

Market Entry and Acceptance: Covid vs Weight-Loss

While Pfizer and Moderna were the big winners at their height, it is worth noting that J&J and AstraZeneca also benefited from being among the first companies to market with COVID-19 vaccines.

On the other hand, Novo Nordisk and Eli Lily are already at market and reaping the benefits of being frontrunners. This means rival manufacturers like Boehringer Ingelheim, Innovent Biologics, Amgen, and Pfizer who are still conducting clinical trials need to compete on price and demonstrate superior efficacy or address unmet needs in the weight-loss treatment landscape to carve out a niche for themselves.

Are You Trialing a Weight-Loss Drug and Need to Meet SIV?

As a leading medical Importer of Record, we are committed to optimizing the clinical trial supply chain, enabling pharmaceutical companies and trial sponsors to focus on groundbreaking medical research and patient care. By ensuring regulatory compliance, facilitating customs clearance, assisting with VAT reclaim, and maintaining supply chain integrity, we play a crucial role in the successful execution of clinical trials. At TecEx Medical, our transparent record-keeping, risk management expertise, and post-trial EOR services enhance the clinical trial supply chain. Together with our partners, we strive to advance medical knowledge and deliver life-saving treatments to patients worldwide, forging a healthier future through efficient global supply chains.